Bitcoin has become a popular digital currency worldwide. Whether you want to invest, trade, or use it, understanding how to buy, sell, and store Bitcoin safely is essential. This guide explains the process step-by-step and covers trading basics and digital wallets.

What Is Bitcoin?

Bitcoin is a decentralized digital currency created in 2009. It works without a central bank and allows peer-to-peer transactions over the internet. Unlike traditional money, Bitcoin is limited in supply, making it a popular choice for investment and online payments.

How to Buy Bitcoin

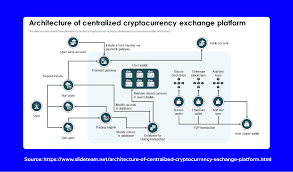

To buy Bitcoin, start by selecting a reliable cryptocurrency exchange such as Coinbase, Binance, or Kraken. Create an account and verify your identity by submitting required documents. Once verified, fund your account using bank transfer, credit/debit card, or other payment methods supported by the exchange.

Next, find Bitcoin (BTC) on the platform and decide how much you want to buy. You don’t need to buy a whole Bitcoin; you can purchase fractions called “Satoshis.” Confirm your purchase, and the Bitcoin will appear in your exchange wallet.

How to Sell Bitcoin

Selling Bitcoin is as straightforward as buying it. Log in to your exchange account, navigate to the Bitcoin section, and choose the amount you want to sell. Confirm the sale, and the proceeds will be added to your exchange balance.

You can withdraw these funds to your linked bank account or use them to buy other cryptocurrencies. Remember to check the fees associated with selling and withdrawing funds, as they vary by platform.

Understanding Bitcoin Trading

Bitcoin trading means buying and selling Bitcoin with the goal of making a profit from price changes. Prices can fluctuate rapidly due to market demand, news, and global economic factors.

There are different types of trading:

- Spot Trading involves buying or selling Bitcoin immediately at the current market price.

- Futures Trading allows contracts to buy or sell Bitcoin at a future date, often using leverage.

- Margin Trading means borrowing funds to trade larger positions, which increases both potential gains and risks.

Beginners should start with spot trading before exploring more complex methods.

What Is a Digital Wallet?

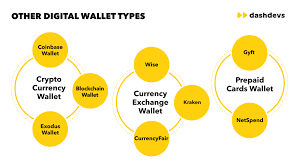

A digital wallet stores your Bitcoin securely and allows you to send and receive cryptocurrency. There are two main types:

- Hot Wallets are online wallets connected to the internet. They are convenient for frequent trading but vulnerable to hacks. Examples include exchange wallets and mobile apps.

- Cold Wallets are offline storage devices like hardware wallets or paper wallets. They offer higher security by keeping private keys offline.

How to Keep Your Bitcoin Safe

Bitcoin security is crucial. Follow these tips to protect your digital assets:

- Use strong, unique passwords for all accounts.

- Enable two-factor authentication (2FA) on exchanges and wallets.

- Store large amounts of Bitcoin in cold wallets.

- Never share your private keys or seed phrases with anyone.

- Be cautious of phishing attempts and scams.

- Regularly update your wallet software.

Choosing the Right Exchange and Wallet

When selecting an exchange, consider factors like fees, ease of use, security features, and customer support. Popular exchanges like Coinbase and Binance offer user-friendly interfaces and strong security.

For wallets, if you trade frequently, a hot wallet might suit you. For long-term holding, investing in a hardware wallet like Ledger or Trezor is recommended.

Top Tips for Buying, Selling, and Trading Bitcoin Safely

- Choose Reputable Exchanges

Always use well-known and regulated platforms like Coinbase, Binance, or Kraken to avoid scams and ensure security. - Start Small and Learn

If you’re new, begin with small amounts to understand how buying, selling, and trading works before investing larger sums. - Use Two-Factor Authentication (2FA)

Enable 2FA on your exchange and wallet accounts to add an extra layer of security beyond just a password. - Keep Your Private Keys Secure

Never share your wallet’s private keys or seed phrases. Losing them means losing access to your Bitcoin permanently. - Diversify Your Wallets

Use hot wallets for daily transactions and cold wallets for storing the bulk of your Bitcoin safely offline. - Stay Updated on Market Trends

Bitcoin prices can be volatile. Follow trusted news sources and market analysis to make informed trading decisions. - Beware of Phishing Scams

Always double-check URLs and avoid clicking suspicious links to protect your accounts from hackers. - Set Realistic Goals

Understand that Bitcoin trading involves risks. Set clear goals and avoid chasing quick profits impulsively. - Keep Backup of Wallet Information

Store backups of your wallet’s recovery phrases in a safe, offline location to prevent loss due to device failure. - Review Fees Before Transactions

Different exchanges have varying fees. Check fees for buying, selling, and withdrawing Bitcoin to avoid surprises.

Q1: How do I buy Bitcoin for the first time?

To buy Bitcoin, sign up on a trusted exchange like Coinbase or Binance, verify your identity, fund your account, and place a buy order for Bitcoin.

Q2: Can I buy less than one Bitcoin?

Yes, Bitcoin is divisible into smaller units called “Satoshis.” You can buy even a tiny fraction based on your budget.

Q3: How do I sell Bitcoin?

Log in to your exchange, enter the amount of Bitcoin to sell, confirm the sale, and withdraw the funds to your bank or keep them on the exchange for trading.

Q4: What is Bitcoin trading?

Bitcoin trading means buying and selling Bitcoin to profit from price changes. It includes spot trading, futures trading, and margin trading.

Q5: What is a digital wallet?

A digital wallet stores your Bitcoin securely. Hot wallets are online and convenient, while cold wallets are offline and safer for long-term storage.

Q6: How can I keep my Bitcoin safe?

Use strong passwords, enable two-factor authentication, store Bitcoin in cold wallets, avoid sharing private keys, and beware of scams.

Q7: Are there fees when buying or selling Bitcoin?

Yes, exchanges charge fees for transactions, deposits, and withdrawals. These vary by platform, so check before trading.

Q8: Which is better: a hot wallet or a cold wallet?

Hot wallets are great for everyday trading but less secure. Cold wallets are recommended for long-term storage due to higher security.

Final Thoughts

Buying, selling, and trading Bitcoin can be rewarding but requires careful understanding and precautions. Use reputable platforms, protect your digital wallets, and stay updated on market trends to make informed decisions. must read thetethers